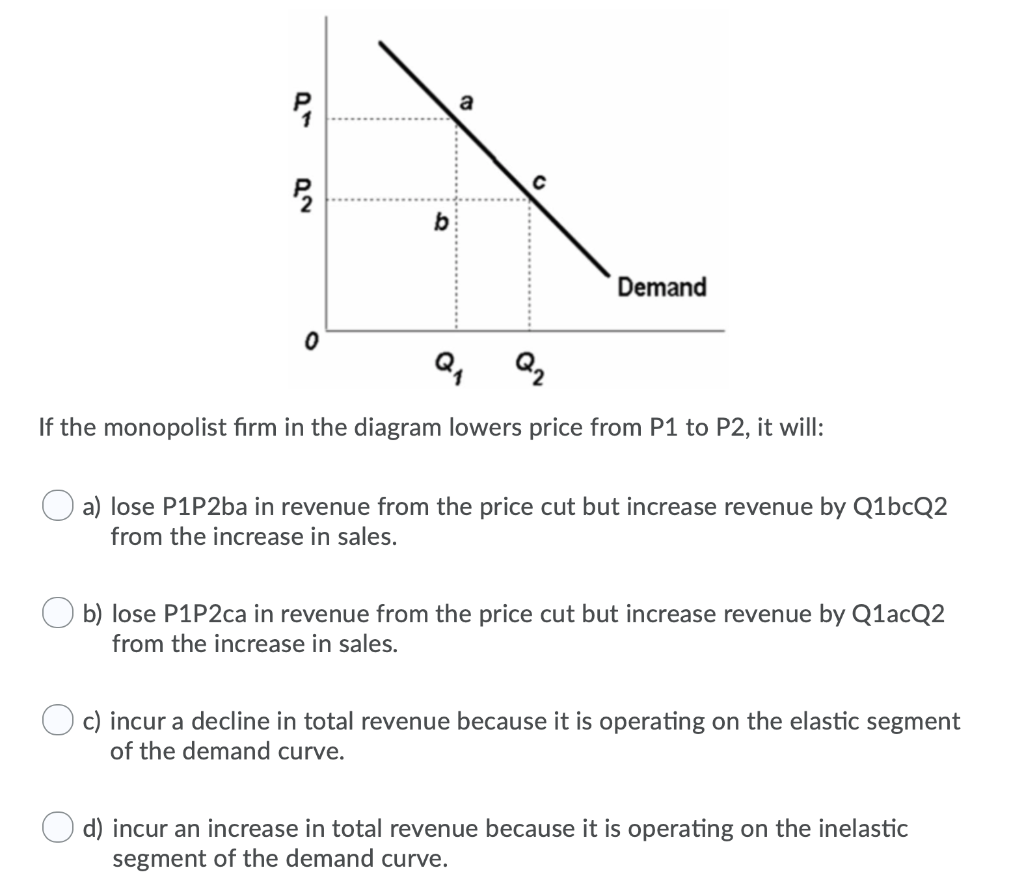

43 If The Firm In The Diagram Lowers Price From P1 To P2, It Will

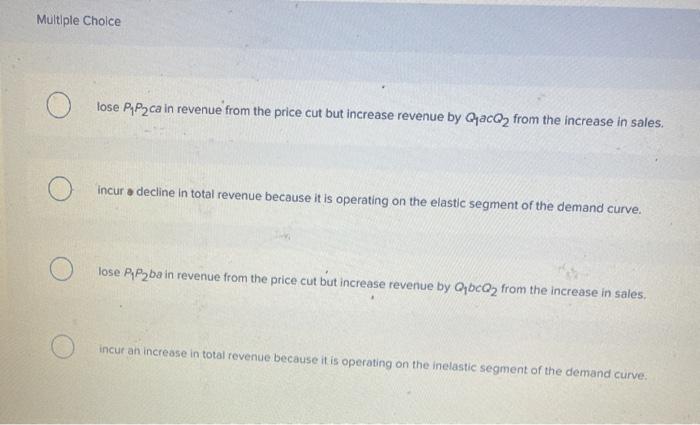

A 17. If the firm in the above diagram lowers price from P1 to P2, it will: A. lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. B. lose P1P2ca in revenue from the price cut but increase revenue by Q1acQ2 from the increase in sales. in quantity demanded due to a change in price is. large. An . inelastic. demand is one in which the change in quantity demanded due to a change in price is . small. The formula used here for computing elasticity . of demand is: (Q1 - Q2) / (Q1 + Q2) (P1 - P2) / (P1 + P2) If the formula creates an . absolute value. greater than 1, the.

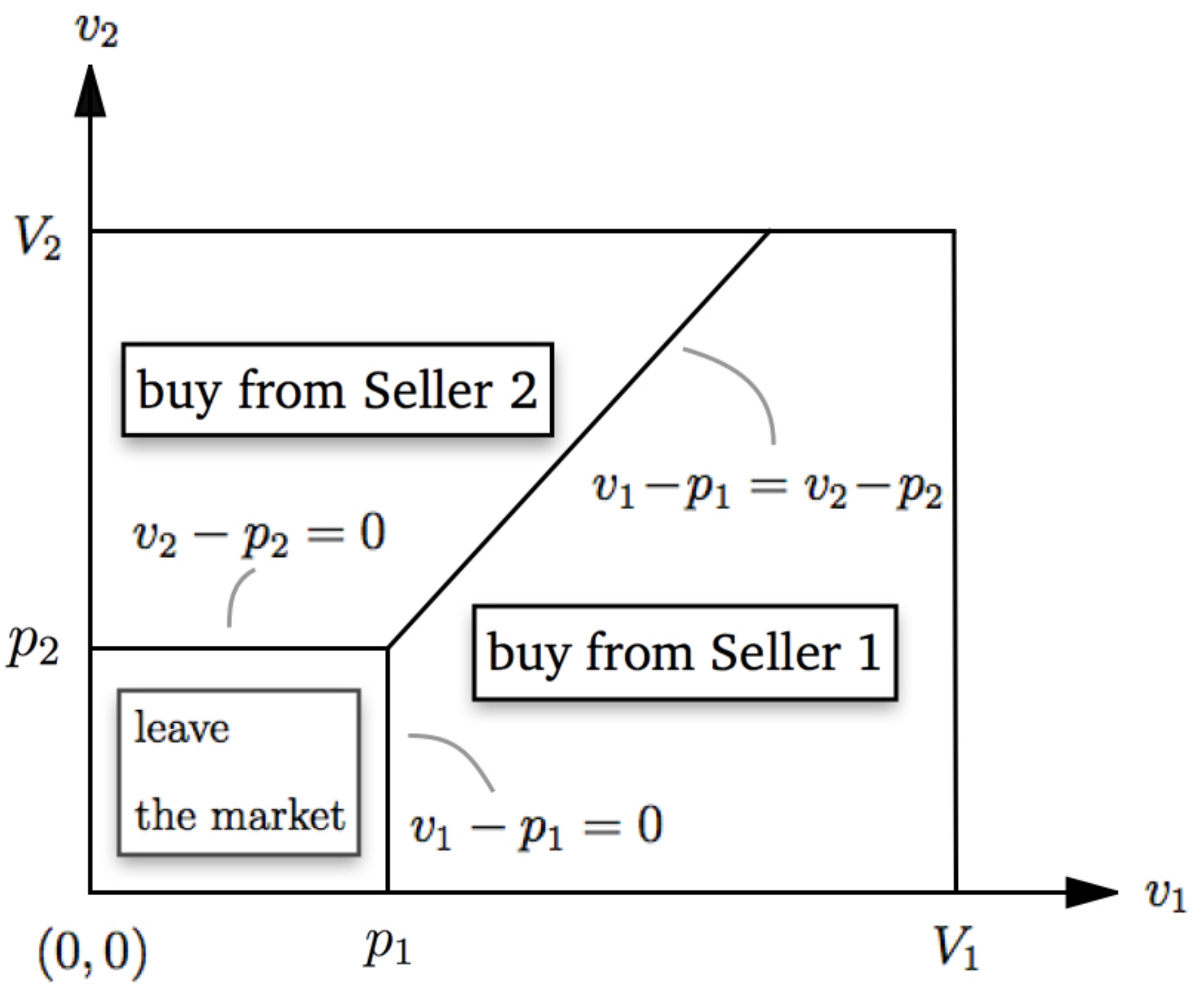

If the firm in the diagram lowers price from P1 to P2, it will lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. The demand curve faced by a pure monopolist

If the firm in the diagram lowers price from p1 to p2, it will

Transcribed image text: Demand If the firm in the diagram lowers price from P1 to P2, it will lose P1 P2 ba in revenue from the price cut but increase revenue by Q1bcQ 2 from the increase in sales. lose P1 P2 ca in revenue from the price cut but increase revenue by Q 1 acQ2 from the increase in sales. o incur a decline in total revenue because it is operating on the elastic segment of the. The monopoly's marginal cost is m = 30. Solve for the equilibrium price in each country. The price-discriminating monopoly maximizes its profit by operating where its marginal revenue for each country equals the firm's marginal cost. Hence, the marginal revenues for the two countries are equal; MR1 = MC = MR2. P1 = 100 - Q1 When market price is P1, a profit maximizing firm's total revenue can be represented by the area. P3 ( Q2. P1 ( Q3. P1 ( Q2. P2 ( Q2. P2 ( Q4. When market price is P4, a profit maximizing firm's total cost can be represented by the area. P4 ( Q1. P1 ( Q4. P4 ( Q4. P2 ( Q4. Total costs cannot be determined from the information in the figure.

If the firm in the diagram lowers price from p1 to p2, it will. -The relative price of good 2 falls. -Fixing utility, buy more x 2 (and less x 1) 2. Income Effect -Purchasing power decreases. -Agent can achieve lower utility. -Will buy more/less of x 2 if inferior/normal. They plan to charge P1 for the first Q1 units and P2 for the subsequent units. The units sold at P2 are the total units sold, Q2, minus the total units sold at P1. The inverse demand curve is P = $100 - Q, and the marginal and average cost is $40. Use calculus to solve for P1, P2, Q1, Q2. If the firm in the diagram lowers price from P1 to P2, it will: ANSWER: lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. 195. Refer to the diagram. The quantitative difference between areas Q1bcQ2 and P1P2ba in the diagram measures: ANSWER: marginal revenue. 196. C) The firm cannot make a profit in the short run because it is too small a part of the total market. D) The firm can sell as much as it wants without having to lower its price. Figure 12 -9 Figure 12 - 9 shows cost and demand curves facing a profit - maximizing, perfectly competitive firm. 21) Refer to Figure 12 -9. At price P 4 , the firm.

What is the allocatively efficient output for the firm represented in the diagram? 23) A) Q 1 units B) Q 2 units C) Q 3 units D) Q 4 units TRUE/FALSE. Write 'A' if the statement is true and 'B' if the statement is false. 24) When a monopolistically competitive firm cuts its price to increase its sales, it experiences a loss in Transcribed image text: Demand If the firm in the diagram lowers price from P1 to P2, it will lose P1 P2 ba in revenue from the price cut but increase revenue by Q1bcQ 2 from the increase in sales. lose P1 P2 ca in revenue from the price cut but increase revenue by Q 1 acQ2 from the increase in sales. o incur a decline in total revenue because it is operating on the elastic segment of the. If the firm in the diagram lowers price from P1 to P2, it will:. Refer to the diagram. If price is reduced from P1 to P2, total revenue will: increase by C-A. To maximize profit, a pure monopolist must: maximize the difference between total revenue and total cost. A single firm producing a product for which there are no close substitutes.. If the firm in the diagram lowers price from P1 to P2, it will. Lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales.

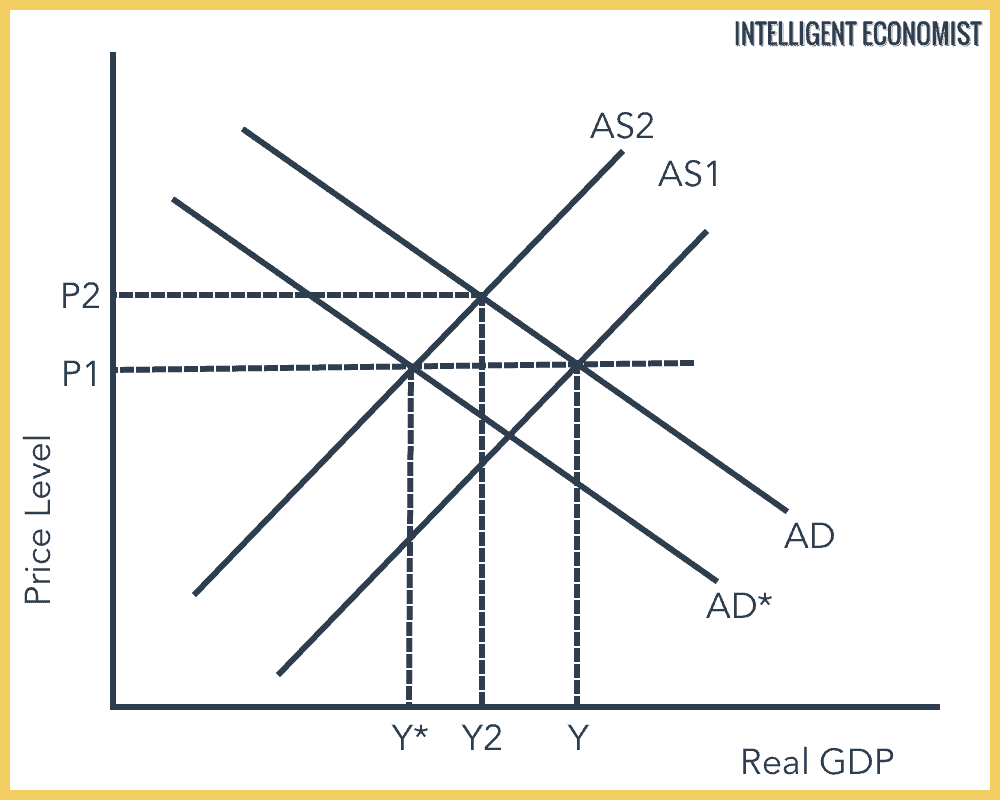

As the price of typewriter falls, firms are not willing to supply more typewriters. This causes a movement downward along the supply curve and forms a new equilibrium point at E2. When firms are operating at point E2, there are lower equilibrium price (Pe to P1) and lower equilibrium quantity (Qe to Q1) in the market of typewriter. 17. If the firm in the above diagram lowers price from P1 to P2, it will: A. lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. B. lose P1P2ca in revenue from the price cut but increase revenue by Q1acQ2 from the increase in sales. Transcribed image text: Demand If the monopolist firm in the diagram lowers price from P1 to P2, it will: O a) lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. Ob) lose P1P2ca in revenue from the price cut but increase revenue by Q1acQ2 from the increase in sales. c) incur a decline in total revenue because it is operating on the elastic. The diagram shows how volume discount would work - customers who do not purchase very much (Q < Q1) pay a higher price (P1), while consumers who purchase more (Q2 < Q < Q3) pay a lower price (P3). Note that the firm captures only a subset of the total consumer surplus. 4. PRICING TO OBSERVABLE MARKET SEGMENTS

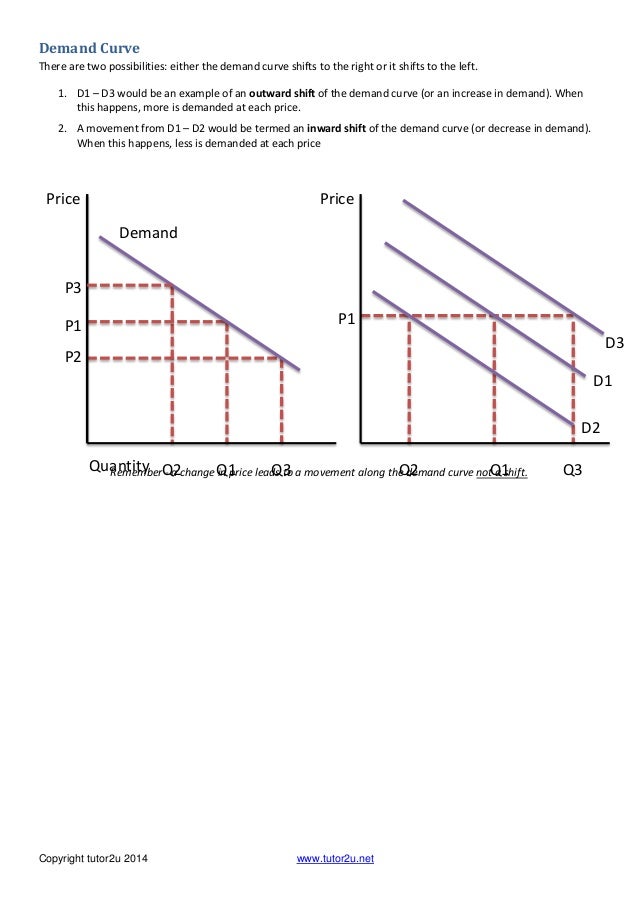

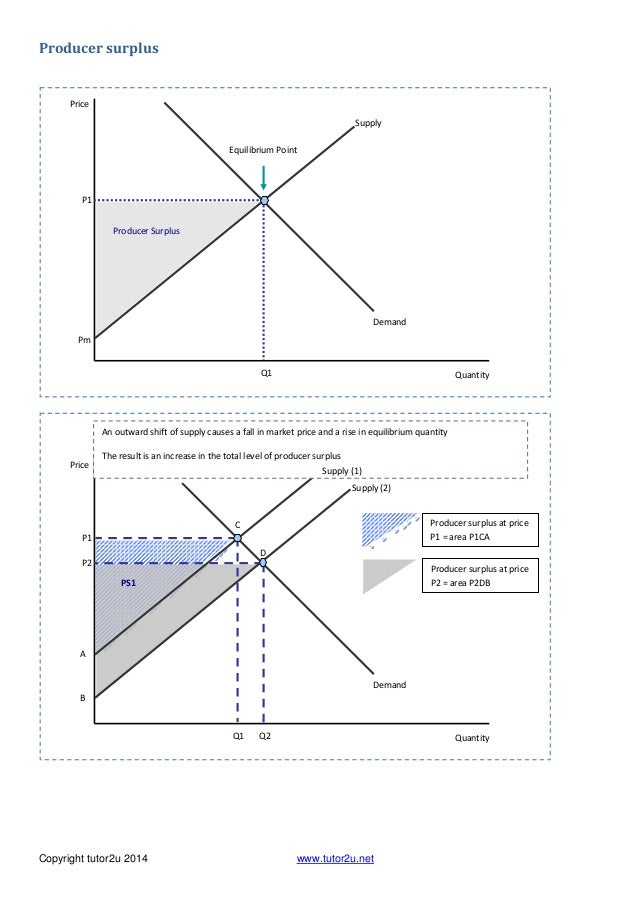

The price before the subsidy is offer is P1 and the equilibrium quantity is Q1 Following the subsidy, the price falls to P2 (this is the price paid by consumers) Output rises to Q2 i.e. the lower price has encouraged an expansion of demand The producer then receives the subsidy P2-P3 and received price P3

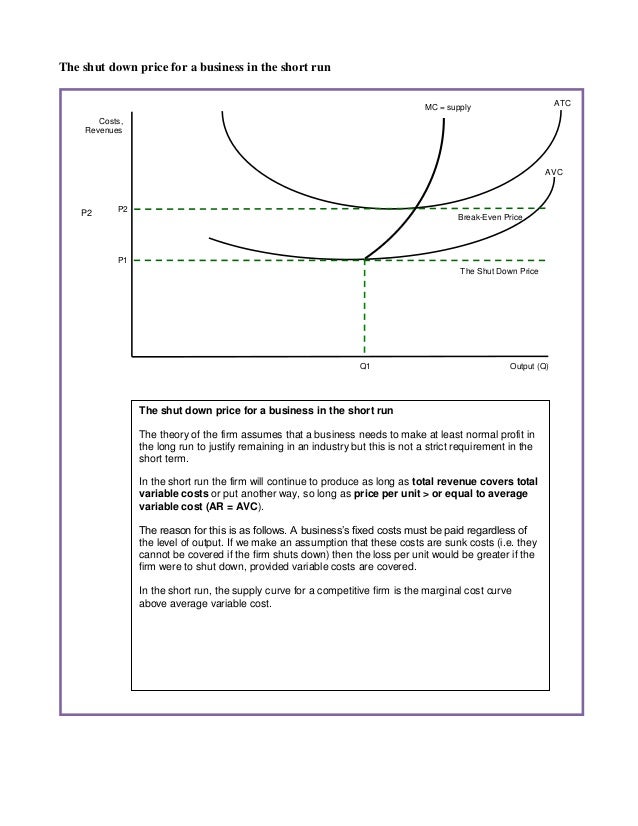

At price P1, the firm will close down.. higher than 100 units, price would be lower than $5, and MR = price. If a monopolist is operating at an output level where marginal revenue is positive, the firm:... Refer to the above diagram. If price is reduced from P1 to P2, total revenue will:

(Supposed to be a graph) In the accompanying diagram, if price is reduced from P1 to P2, total revenue will a.) increase by A −C. b.) increase by C −A. c.) decrease by A −C. d.) decrease by C −A.

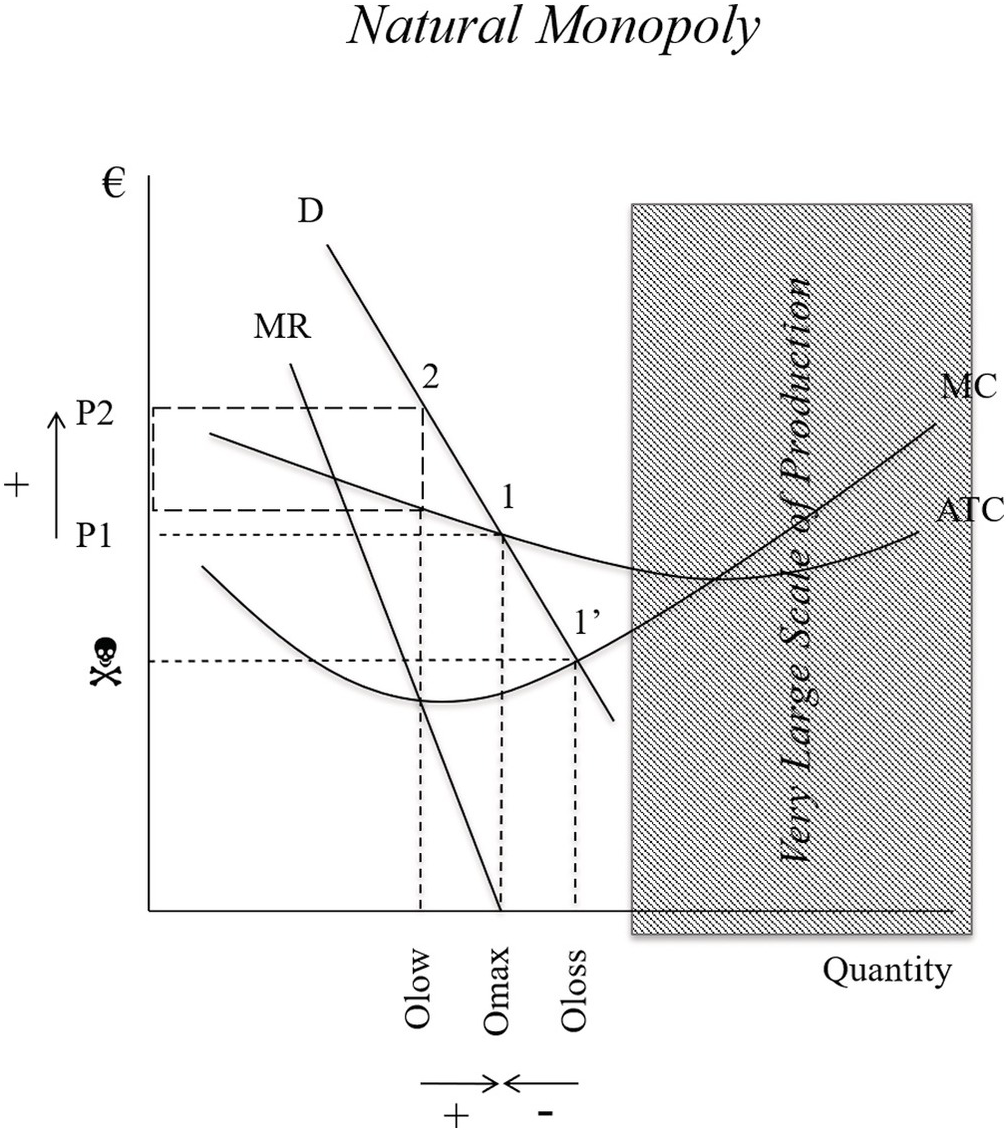

Therefore, if MC rises by 25 percent price, then price will also rise by 25 percent. When MC = $20, P = $40. When MC rises to $20(1.25) = $25, the price rises to $50, a 25% increase. 4. A firm faces the following average revenue (demand) curve: P = 100 - 0.01Q where Q is weekly production and P is price, measured in cents per unit. The firm's.

The monopoly's marginal cost is m = 30. Solve for the equilibrium price in each country. The price-discriminating monopoly maximizes its profit by operating where its marginal revenue for each country equals the firm's marginal cost. Hence, the marginal revenues for the two countries are equal; MR1 = MC = MR2. P1 = 100 - Q1

If the firm in the above diagram lowers price from P1 to P2, it will: A) lose P1P 2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales. B) lose P1P 2ca in revenue from the price cut but increase revenue by Q1acQ2 from the increase in sales.

3 3 Given Q 2 *, firm 1 will maximize its profit by choosing Q 1 * and, given Q 1 *, firm 2 will maximize its profit by choosing Q 2 *. In other words, the pair (Q 1 *, Q 2 *) constitutes a Nash equilibrium: no firm has an incentive to take unilateral deviations.

The firm would have to lower its price to sell more than 10 units.. price at P1, and suffer a loss. Q2, price at P2, and earn an economic profit . Q2, price at P2, and earn only a normal profit . Tags: Question 31 . SURVEY . 60 seconds . Q. For an unregulated monopolist, the profit-maximizing quantity will always be:

P2. If a nondiscriminating imperfectly competitive firm is selling its 100th unit of output for $35, its marginal revenue: will be less than $35. If the firm in the diagram lowers price from P1 to P2, it will: lose P1P2ba in revenue from the price cut but increase revenue by Q1bcQ2 from the increase in sales.

When market price is P1, a profit maximizing firm's total revenue can be represented by the area. P3 ( Q2. P1 ( Q3. P1 ( Q2. P2 ( Q2. P2 ( Q4. When market price is P4, a profit maximizing firm's total cost can be represented by the area. P4 ( Q1. P1 ( Q4. P4 ( Q4. P2 ( Q4. Total costs cannot be determined from the information in the figure.

If a perfectly competitive firm can sell 200 computers at $700 each, in order to sell one more computer, the firm: A) Must lower its price. B) Can raise its price. C) Can sell the 201 st computer at $700. D) Cannot sell an additional computer at any price because the market is at equilibrium.

Lower costs allows a profit maximising firm to charge a lower price (P2) but make higher total profits because of the fall in AC per unit Costs Output (Q) SRAC1 SRAC3 AR (Demand) MR MC1 MC2 P1 P2 Q1 Q2 Profit at Price P1 Profit at Price P2 Costs Output (Q) SRAC1 SRAC2 SRAC3 Q1 Q2 Q3 AC1 AC2 AC3 LRAC

Thus,the monopoly will charge a price (P1). In Step 3, the monopoly identifies its profit. Total revenue will be Q1 multiplied by P1. Total cost will be Q1 multiplied by the average cost of producing Q1, which is shown by point S on the average cost curve to be P2.

(price lower by one, quantity demanded increase by one) Refer to the above data.. If a firm finds that it can sell $13,000 worth of a product when its price is $5 per unit and $11,000 worth of it when its price is $6, then:... Refer to the above diagram. If price falls from P1 to P2, total revenue will become area(s): A. B+D.

Suppose firm 1 takes firm 2's output choice q2 as given. Then firm 1's problem is to maximize its profit by choosing its output level q1. If firm 1 produces q1 units and firm 2 produces q2 units then total quantity supplied is q1 + q2. Define Q ≡ q1 + q2. The market price will be P =130 − q1 − q2. Firm 1's profit maximization problem:

Refer to the above diagram. If the firm in the above diagram lowers price from p1 to p2 it will. Assuming the prices of resources a and b are 5 and 8. Refer to the above diagram. Incur a decline in total revenue because it is operating on the elastic segment of the demand curve. Refer to the above diagram.

/Supplyrelationship-c0f71135bc884f4b8e5d063eed128b52.png)

/law_of_demand_chart2-5a33e7fc7c394604977f540064b8e404.png)

0 Response to "43 If The Firm In The Diagram Lowers Price From P1 To P2, It Will"

Post a Comment