42 covered call payoff diagram

Covered Call | Definition | Payoff Formula | Example - XPLAIND.com = 100 × ($0 − $155 − max [0, $0 - $160] + $10) The profit calculated above can be plotted as shown below. This the profit diagram of a covered call. by Obaidullah Jan, ACA, CFA and last modified on Feb 14, 2018 EXAM IFM SAMPLE QUESTIONS AND SOLUTIONS … (E) –22.64 “Written” Covered Call . 14. The current price of a non-dividend paying stock is 40 and the continuously compounded risk-free interest rate is 8%. You are given that the price of a 35-strike call option is 3.35 higher than the price of a 40-strike call option, where both options expire in 3 months.

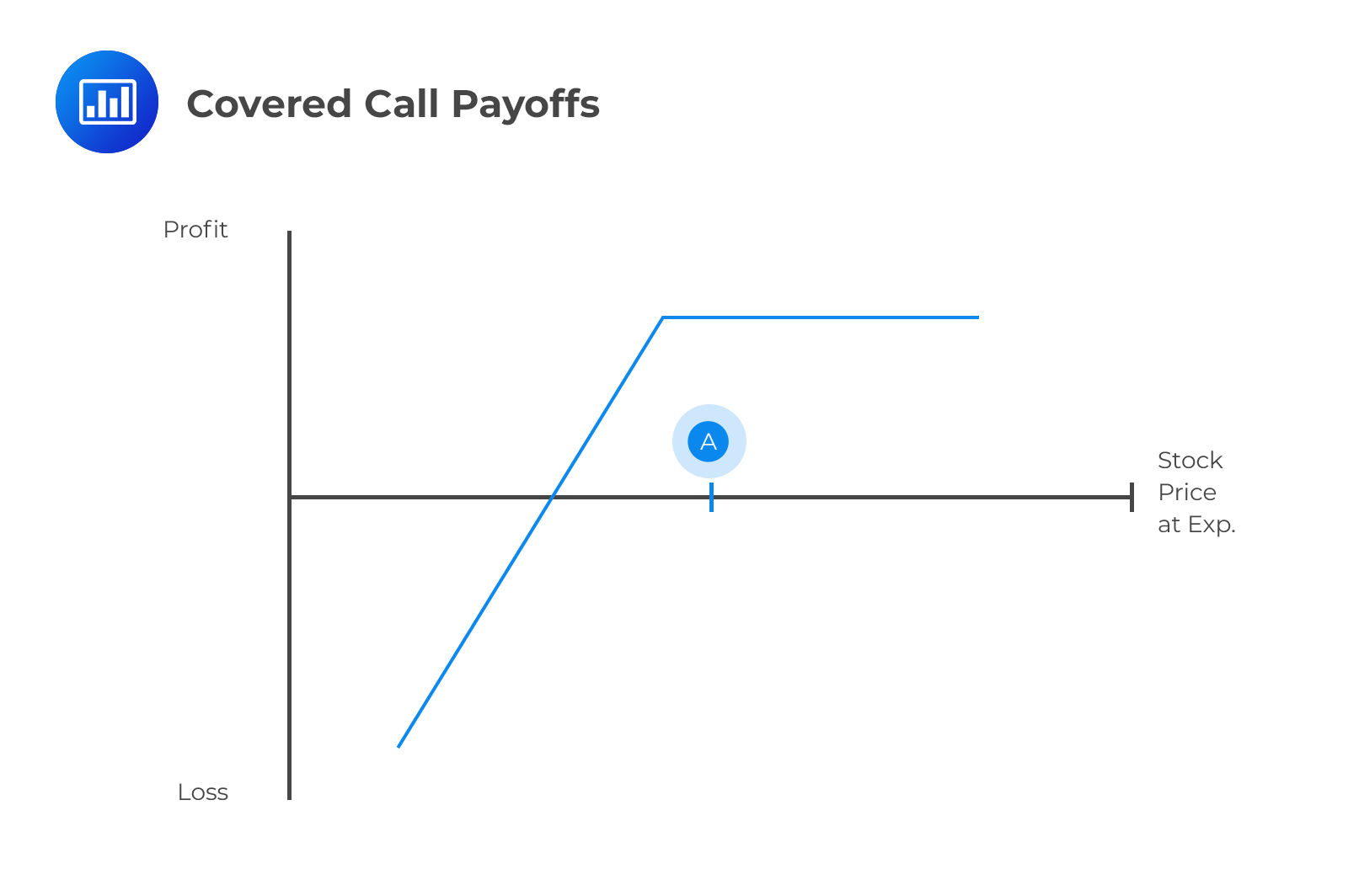

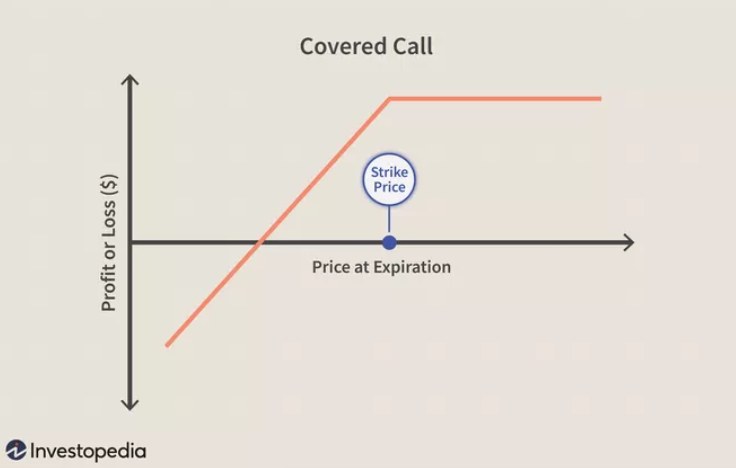

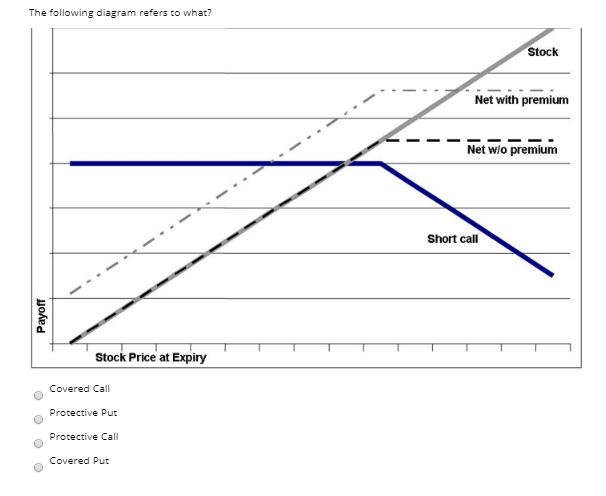

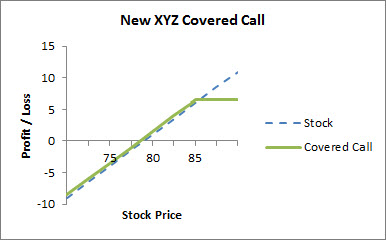

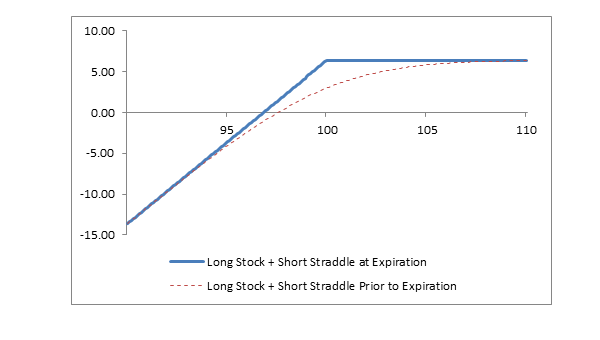

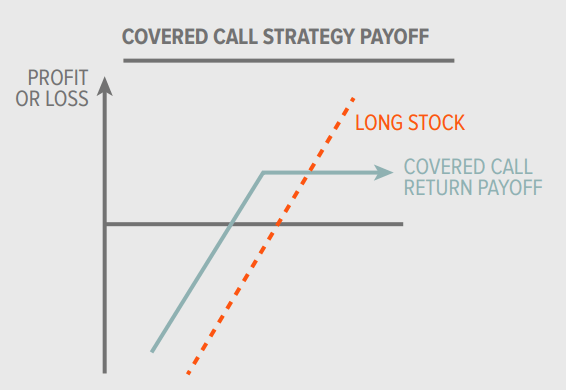

Covered Call Strategy Cheat Sheet - StockViz Otherwise, your upside on owning the stock is capped at the strike. The payoff diagram of a covered call looks like this: The authors claim that over a quarter of a covered call's risk may be attributed to market timing and investors are ignoring its effect on returns.

Covered call payoff diagram

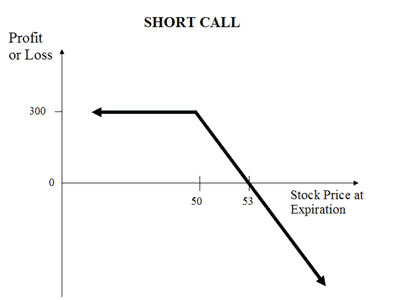

Systematic Options Trading Course You should be aware of the basics of options such as call and put options and have knowledge of the payoff from call and put options. It is also assumed that a learner knows how to place an order to buy and sell options and concepts such as strike price, expiry date, and underlying asset. You can check out our course on Options Trading ... Understanding Option Payoff Charts 06/02/2017 · Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. If the shares trade anywhere below $25 then we keep ... Call writer payoff diagram (video) | Khan Academy If the stock goes above $50 we would exercise our option to buy at $50. Say the stock is at $60 the underline stock is at $60 on that date at the expiration date, then we would exercise our option to buy at $50 and sell at $60 and make $10. We would essentially get this upside above $50 on the stock.

Covered call payoff diagram. Covered Call - Definition, Practical Example, and Scenarios You will receive $105 per share (strike price of the option) and the $3 per share from the call premium. In this covered call scenario, you've sacrificed a small portion of potential profit in return for risk protection. Scenario 3: Stock price decreases to $90. In such a case, the call option will expire similarly to scenario 1. Fifth harmony heardle - wzka.maxgrawer.pl 06/09/2022 · Fifth Harmony covered this song on X Factor on the sixth week of the show. Fifth Harmony also covered this song featuring Demi Lovato in the finals. Fifth Harmony "Give Your Heart a Break" - Live Week 6 - The X Factor USA 2012. how long can you keep your car at a park and ride. Intersky Falcon. 1st. 5th. 2001/02. Landing Light. 1st. 5th. Since 2001, five Fighting … Put Option Payoff Diagram and Formula - Macroption As you can see in the diagram, a long put option's payoff is in the positive territory on the left side of the chart and the total profit increases as the underlying price goes down. The relationships is linear and the slope depends on position size. In this case, with 1 contract representing 100 shares, the profit increases by $100 for every $1 decrease in underlying price. Covered Call Income Generation (With Excel Template) - Stock Research Tool The payoff diagram for this covered call will look as follows: Option Strategies Excel Template You can download the attached Covered Call Strategy excel template that you can use to form a "covered call" strategy for any stock. The template allows you specify a stock and an options contract for that stock.

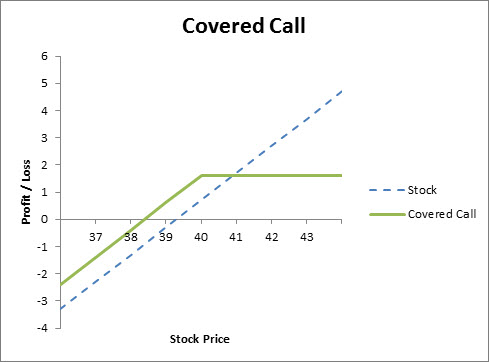

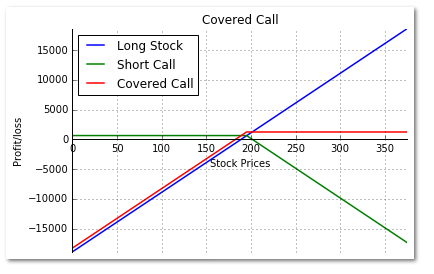

Covered Calls Explained | Online Option Trading Guide The OTM covered call is a popular strategy as the investor gets to collect premium while being able to enjoy capital gains (albeit limited) if the underlying stock rallies. Covered Call Payoff Diagram 0.00% Commissions Option Trading! Trade options FREE For 60 Days when you Open a New OptionsHouse Account Limited Profit Potential Covered Calls Basics: Risks & Advantages Overview - Investopedia A covered call is constructed by holding a long position in a stock and then selling (writing) call options on that same asset, representing the same size as the underlying long position. A covered... Covered Call Options Trading Strategy Explained - Investing Fuse Covered Call Payoff Diagram (covered call payoff diagram) From the payoff diagram above, you can see that the covered call has virtually an unlimited loss potential and limited profit potential. This can help visualize the payoff so you know your risk and rewards. Covered Call Construction In-The-Money Covered Call Explained | Online Option Trading Guide In-The-Money Covered Call. Writing in-the-money calls is a good strategy to use if the options trader is looking to earn a consistent moderate rate of return. Profit is limited to the premium earned as the writer of the call option will not be able to profit from a rise in the price of the underlying security. Offers more downside protection as ...

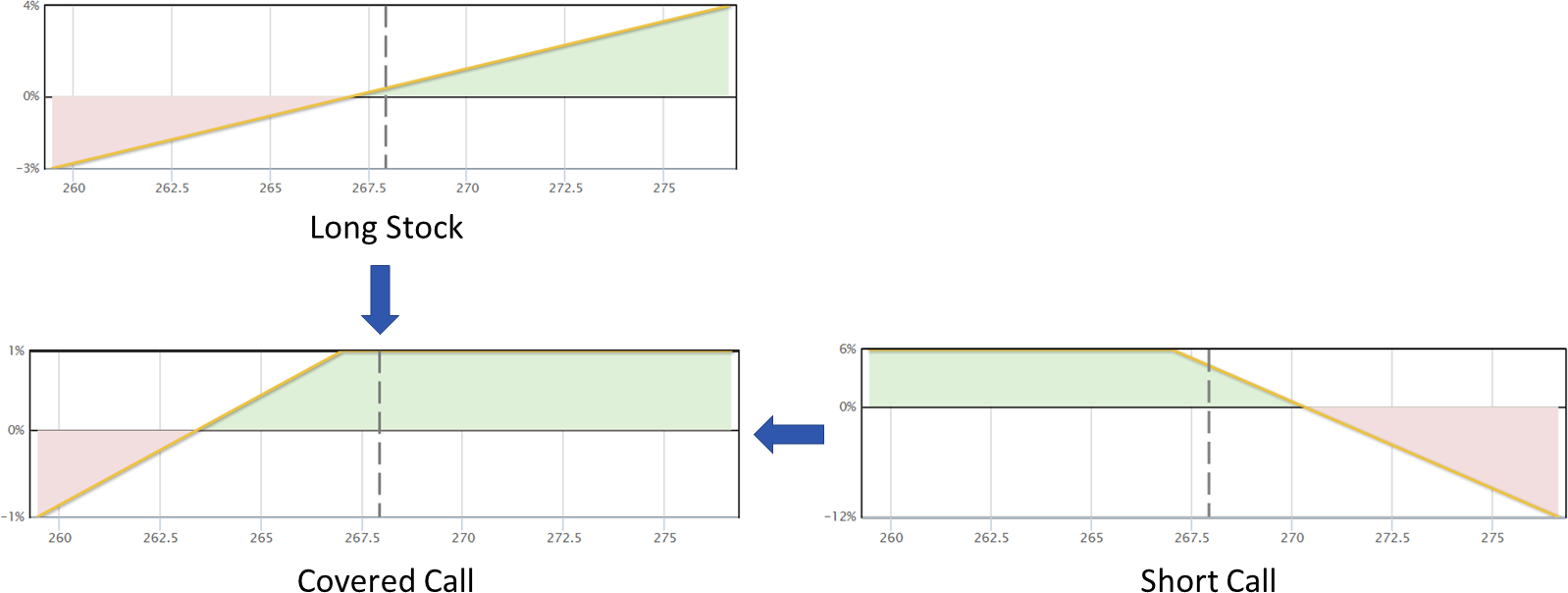

Covered Calls and Puts Explained | Trade Options With Me When you look at the payoff diagram of the selling covered calls strategy, you can see that it looks somewhat similar to the payoff diagram of a stock and a credit spread. The downside is exactly the same as the one of a normal stock and the upside is just like one of a credit spread. So if the price of the underlying moves down, you lose money ... The Best Way to Handle Another Person's Insurance Company It’s not unusual for both the at-fault and innocent driver to be covered by the same insurance company. The insurance company will investigate the accident and reach a decision as to who is at fault. If you disagree with this decision, you’ll need to write a letter to your insurance company disputing their finding of liability (and providing any evidence you may have). If the insurance ... Covered Call | Options Strategy Writing, Payoff Formula, Example The net payoff will be 400+200= ₹600. In this case, if the covered call was not created, the profit would have been only (54-50)*100= ₹400. Thus, the covered call is beneficial only when the prices move moderately Scenario 3: If the stock price of Adani Power falls to ₹40, the trader will incur a loss. The total loss is equal to (50-40)*100= ₹1000. Call Option Payoff - Epsilon Options A call option payoff depends on stock price: a long call is profitable above the breakeven point (strike price plus option premium). The opposite is the case for a short call. A call option payoff diagram shows the potential value of the call as a function of the price of the underlying asset usually, but not always, at option expiration.

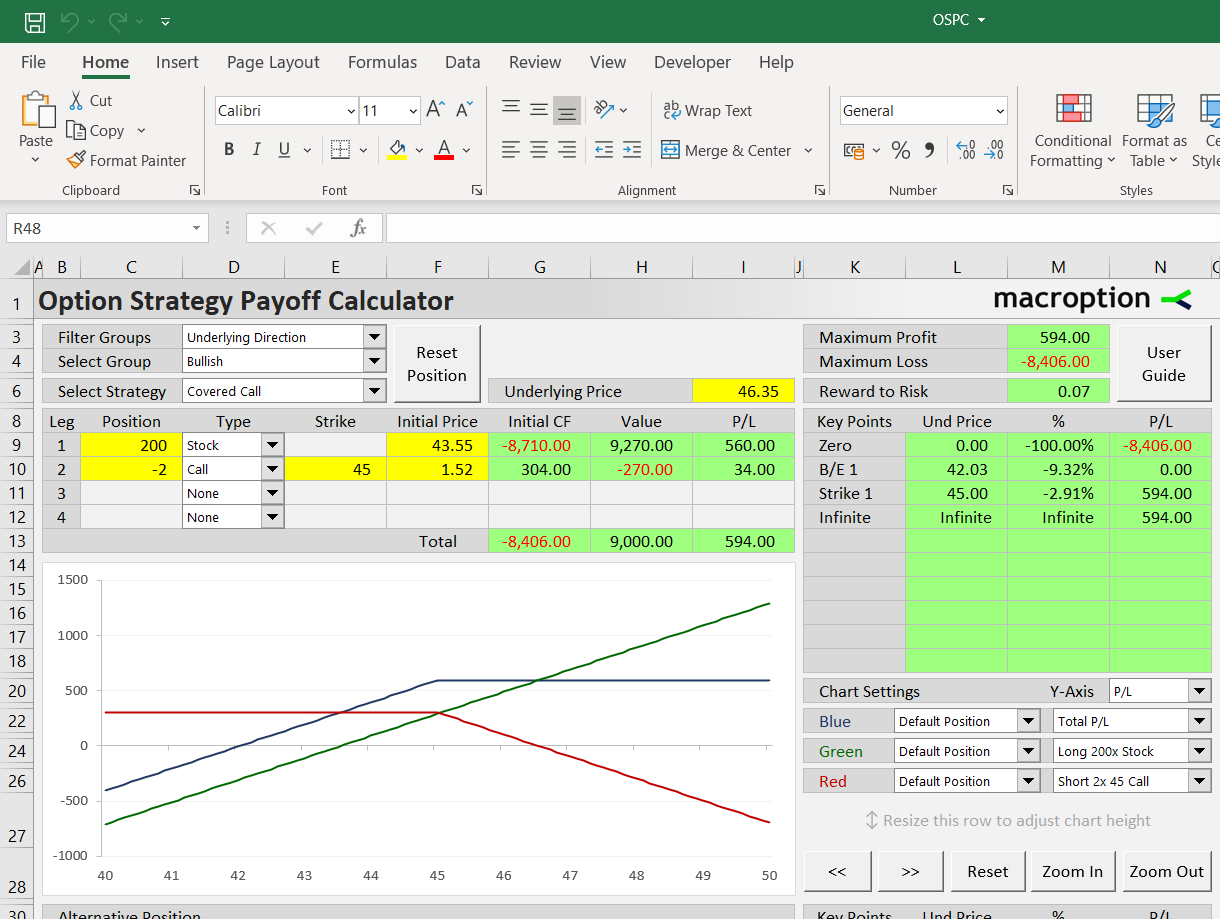

Options Strategy Payoff Calculator Excel Sheet - Trading Tuitions Looking at a payoff diagram for a strategy, we get a clear picture of how the strategy may perform at various expiry prices. By seeing the payoff diagram of a call option, we can understand at a glance that if the price of underlying on expiry is lower than the strike price, the call options holders will lose money equal to the premium paid, but if the underlying asset price is more than the ...

Covered Call Strategy Guide [Setup, Entry, Adjustment, Exit] A covered call consists of selling a call against shares of long stock. Typically, covered calls are sold out-of-the-money above the current price of the underlying asset. Calls that are sold closer to the stock price will result in more credit received but have a higher probability of being in-the-money at expiration.

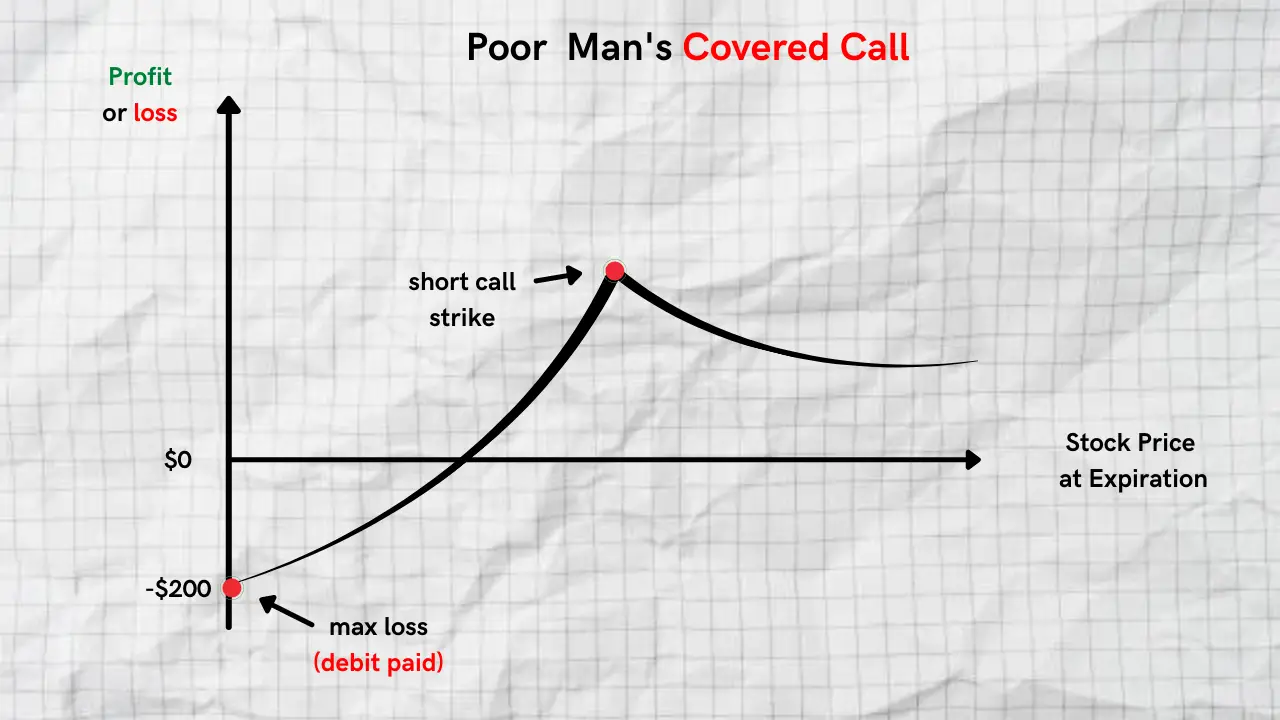

The Synthetic Covered Call Options Strategy Explained This is the classic covered call. Should the stock be below $50 in a month, the investor keeps the $5. If the stock rises above $50 their shares would be called away - in effect sold at $50 at zero profit or loss plus the $5 premium. The only 'loss' would be if the price rose over $50 - $60, say. Then the $10 rise would be lost as the investor

Butterfly (options) - Wikipedia Long butterfly. A long butterfly position will make profit if the future volatility is lower than the implied volatility.. A long butterfly options strategy consists of the following options: . Long 1 call with a strike price of (X − a); Short 2 calls with a strike price of X; Long 1 call with a strike price of (X + a) where X = the spot price (i.e. current market price of underlying) and a > 0.

Covered Call: Option Strategy Payoff Calculator - Macroption Payoff Diagrams The chart in the middle of the Main sheet can display payoff diagram for the entire covered call, as well as individual legs. You can select individual chart series in the dropdown boxes in cells K22-N26. You can also adjust the chart scale using the buttons below. Position Variations (Choosing Different Strikes)

Covered Call - aka Buywrite Strategy The idea behind a Covered Call (also called Covered Write) is to hold stock over a long period of time and every month or so sell out-of-the-money call options. Even though the payoff diagram shows an unlimited loss potential, you must remember that many investors implementing this type of strategy have bought the stock long ago and hence the ...

Call Option |Definition | Intrinsic and Time Value | Payoff Diagram ... The writer's payoff diagram is presented in the figure below. At any level where the spot price is below the strike price, a call option is out of the money. In such a case, the profit of the writer equals the amount of premium received. If the spot price of the underlying stock exceeds the strike price, the buyer will exercise the contract.

Anatomy of a Covered Call - Fidelity In the diagram below, the hyphenated light-blue line that slopes from lower left to upper right shows just the stock position, which is purchased at $39.30 per share. The solid green line is the covered call position, which is the combination of the purchased stock and the sold call.

Poor Man's Covered Call Explained -InvestingFuse (poor mans covered call payoff diagram) The poor man's covered call is entered into with a net debit and it consists of the following two contracts below. Buying an in-the-money (ITM) call option with a longer expiration cycle Selling an out-of-the-money (OTM) call option with a shorter expiration cycle

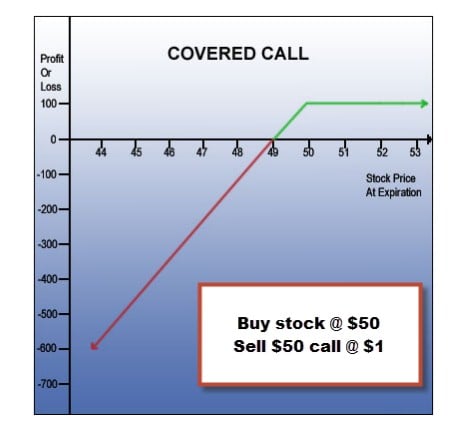

Covered Call Option Payoff Graph - Options Trading IQ The below covered call option payoff is from Interactive Brokers. The covered call option was an AAPL 110 strike call sold for $4.20 per contract or $420 in total and a long position bought at $106.10 per share. The breakeven price at expiration is $101.90 (long position bought price minus premium received).

(PDF) INVESTMENTS BODIE SOLUTION MANUAL | REN Jie INVESTMENTS BODIE SOLUTION MANUAL. Enter the email address you signed up with and we'll email you a reset link.

Covered Call: How to Generate Passive Income With It The payoff diagram below shows the profit-and-loss line (orange) of a covered call strategy, where the breakeven point is denoted by the intersection of the orange line with the price line (black). Above the breakeven point, the profit increases incrementally until the asset price reaches the strike price (in this case, the sweet spot), at ...

Call Option Payoff Diagram, Formula and Logic - Macroption The payoff diagram shows how the option's total profit or loss (Y-axis) depends on underlying price (X-axis). The key variables are: Strike price (45 in the example above) Initial price at which you have bought the option (2.88 in the example) Current underlying price (the chart's X-axis)

Covered call versus naked call option strategies - FlowBank Covered and naked call options strategies are a way to express a bearish view with options. We compare the two and explain the objectives and risks. Private; ... Payoff diagram. This represents what the profit and loss the covered call options writer can expect to make given the movement in the asset price relative to the premium they received.

Covered Call Option Strategy - Definition and Examples If you had sold a Covered Call (you own 100 shares of XYZ): your P/L would be: $300. Calculated as follows: Profit on 100 shares: 100 x ($40-$10) = +$3000; ... Covered Call Payoff Diagram. Maximum Loss. As we've seen above, in this strategy, risk is on the downside. The shares that I hold can significantly decrease in value by the time the ...

Profit And Loss Graphs For Covered Call Writing P& L graph for covered call writing of a $50 stock and a $1 call option Every strategy has its advantages and disadvantages and the P& L graph gives us an outstanding depiction of those pros and cons for covered call writing: We immediately have an initial gain of $100 upon entering our position

Covered Strangle: Ultimate Guide To The Covered Strangle With a covered strangle, the trade will profit provided that any loss on the share position is not greater than the premium received for selling the call and put. Payoff Diagram The payoff diagram is like that of a covered call, with one main difference.

23 Best Skin Care Tech Devices 2021 | The Strategist Sep 14, 2021 · We asked six skin care experts about the best tech beauty devices on the market and surfaced 23 products to help with acne, aging, hyperpigmentation, hair removal, and everyday maintenance from ...

Writing Covered Calls To Protect Your Stock Portfolio Payoff diagram for selling a call option (Y axis is profit or loss) The graph to the left shows the payoff diagram for writing (a.k.a. selling) a call option. It's pretty much exactly the reverse of the previous one. Notice that the blue payoff line now starts above $0 for low stock prices all the way up to our strike price.

Reference Architecture: Citrix DaaS - AWS | Citrix Tech Zone 14/09/2022 · Diagram 12: Traffic flow before and after HA failover in multi-AZ HA deployment Diagram 12: Traffic flow before and after HA failover in multi-AZ HA deployment. In the preceding diagram, we can see that each ADC has a different Gateway virtual IP (VIP). This is characteristic of an Independent Network Configuration (INC). When VPXs in an HA ...

Call writer payoff diagram (video) | Khan Academy If the stock goes above $50 we would exercise our option to buy at $50. Say the stock is at $60 the underline stock is at $60 on that date at the expiration date, then we would exercise our option to buy at $50 and sell at $60 and make $10. We would essentially get this upside above $50 on the stock.

Understanding Option Payoff Charts 06/02/2017 · Selling a Call Payoff. When we reverse the position and sell a call option, here is the payoff diagram for that. We have the same format of stock price on the x-axis (horizontal) and P&L on the y-axis (vertical). Because we sold the call, we receive money for the sale, which is the premium. If the shares trade anywhere below $25 then we keep ...

Systematic Options Trading Course You should be aware of the basics of options such as call and put options and have knowledge of the payoff from call and put options. It is also assumed that a learner knows how to place an order to buy and sell options and concepts such as strike price, expiry date, and underlying asset. You can check out our course on Options Trading ...

0 Response to "42 covered call payoff diagram"

Post a Comment